Abandoned Eyesores Almost Certain to Proliferate Across the Maine Countryside Unless We Stop Them

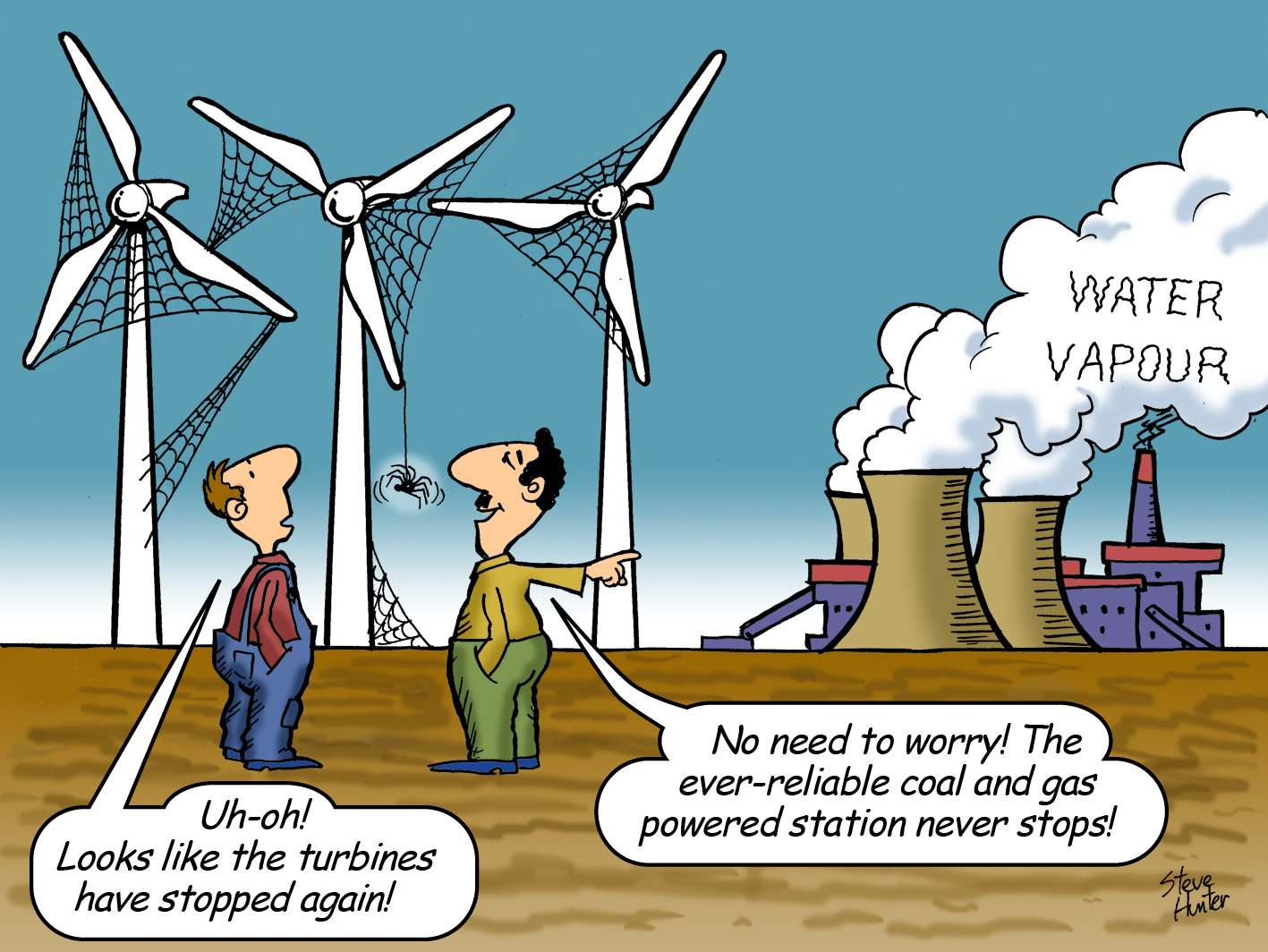

Wind companies do everything they can to get as much of the money generated by a wind project upfront or as frontloaded as possible.

They also avoid at all costs buying the land, because ownership comes with responsibilities. Instead, they typically lease the land for their monstrosities so that when they’ve wrung it for money, they can simply abandon the turbines, leaving the unwitting lessors stuck with the rusting and leaking hulks.

On February 17, 2012, the wind industry itself warned of more abandoned projects: “The wind power industry is predicting massive layoffs and stalled or abandoned projects after a deal to renew a tax credit failed Thursday in Washington.”

Contrary to wind industry propaganda, there is very little salvage value in these galvanized steel ghosts. Rather, their necessary removal is a huge expense.

There are reportedly thousands of abandoned wind turbines across the U.S.

What will you do to make sure your area does not become part of this growing scourge?

On January 12, 2012, the Co-Chairs of the Citizens’ Task Force on Wind Power – Maine wrote a report to the Maine legislature which included the following on decommissioning of wind turbines:

Decommissioning language in permits issued is not in compliance with the statute, that specifically states that decommissioning must be planned without regard to the applicant’s future financial condition. The DEP’s wind project application form does not require, as the statute states, that an applicant demonstrate how decommissioning will be funded in a way that is not dependent on future financial condition, only that a decommissioning plan is submitted. The statute intends that the risks of decommissioning remain with the applicant. The only way to insure this is to require the establishment of a creditor and bankruptcy remote fund at the beginning. The Vermont Public Service Board, in the Deerfield Wind decision, Docket 7250, included conditions for decommissioning which should be a model for Maine:

VI. DECOMMISSIONING FUND

We require Deerfield to file a Decommissioning Plan with the Board and parties prior to commencement of construction. The Plan shall include a revised estimate of the costs of decommissioning, covering all of the activities specified in the Decommissioning Plan, and shall contain certification that the cost estimate has been prepared by a person(s) with appropriate knowledge and experience in wind generation projects and cost estimating. Also, the Plan may allow the Decommissioning Fund to grow as the construction process proceeds such that the funding level is commensurate with the costs of removing infrastructure in place. The amount of the Fund may not net out the projected salvage value of the infrastructure. In addition, we require that the Decommissioning Plan include a copy of the Letter of Credit to be posted by Deerfield to secure the full amount of the Fund, and demonstrate how the Fund will be creditor and bankruptcy remote in the event of Deerfield’s insolvency or business failure. We further require that the Letter of Credit be issued by an A-rated financial institution and that it name the Vermont Public Service Board as the designated beneficiary. The Letter of Credit shall be an “irrevocable standby” letter of credit and shall include an auto-extension provision (i.e. “evergreen clause”).

Similar to the approach we approved in the UPC Vermont Wind Docket102 we adopt the Department’s recommendation that a trigger be set for decommissioning review. Therefore, if actual production falls below 65% of projected production during any consecutive two-year period, a decommissioning review will be initiated.103 However, in the event that Deerfield can show that it has entered into stably-priced power contracts with Vermont utilities through which a substantial amount of power is to be sold to Vermont utilities at stable prices, we may reduce the decommissioning trigger to as low as 50% if we find that those contracts provide sufficient benefit to Vermont ratepayers. In any case, Deerfield would have the opportunity to demonstrate during this review that there are reasons for the decline in production such that the project should not be removed.