Canberra urged to strip billions from windfarm subsidies

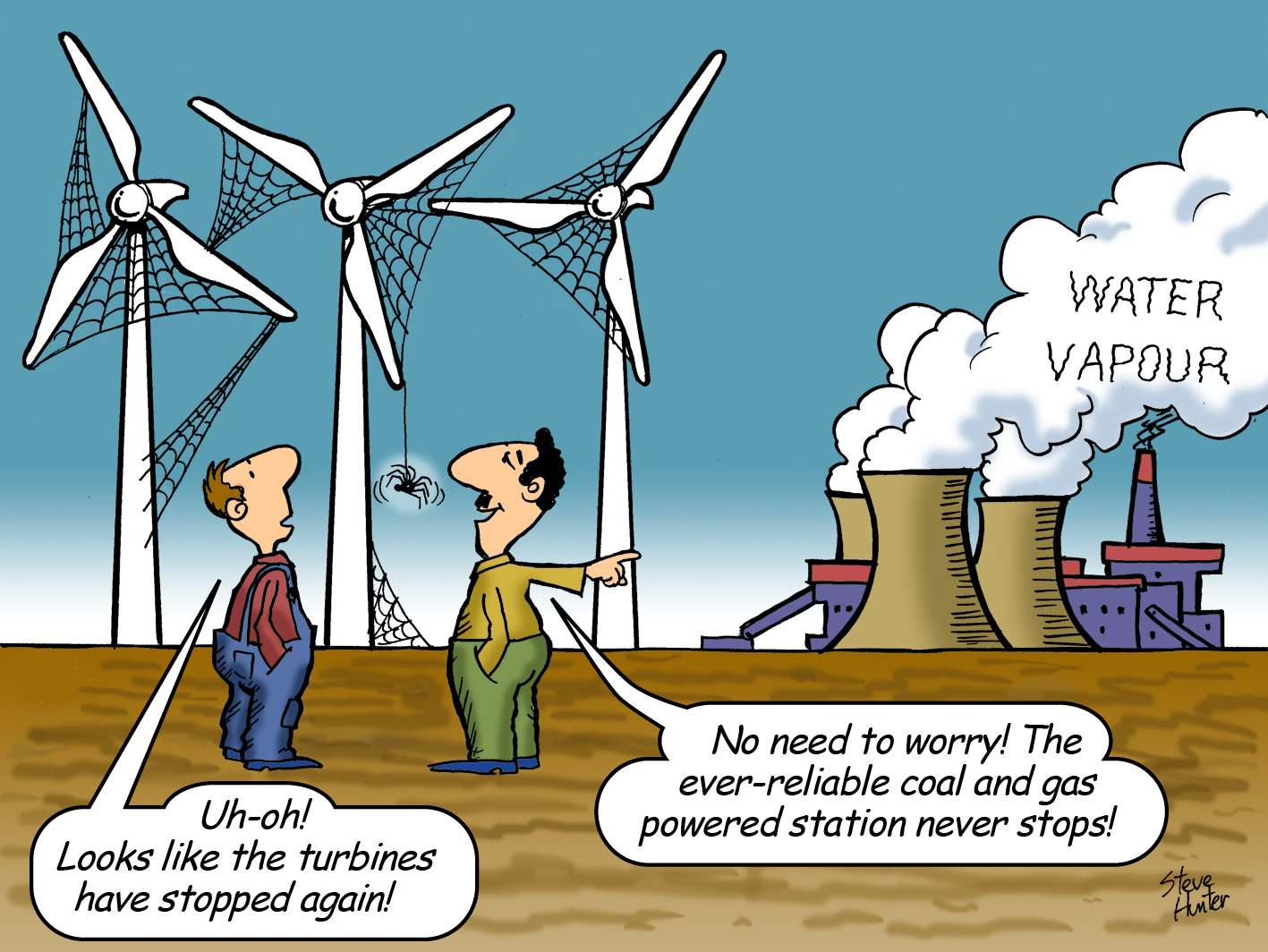

The Abbott government is being urged to strip billions more from subsidies to wind farms in the final report of a Senate committee that has already pushed renewable energy investment to favour solar.

In its recommendations, the committee says renewable energy subsidies for new wind farms should be limited to five years from more than 20.

It also wants the issue of renewable energy certificates restricted to projects in states that adopt federal regulations on infrasound and low frequency noise.

The final report of the Senate investigation into wind farms and their possible health effects will be tabled in parliament on Monday.

The report has been circulated and details have been provided to The Australian.

The call for time limits on subsidies and federal noise oversight is likely to provoke a backlash from the wind industry, already reeling from a federal government directive to the $10 billion Clean Energy Finance Corporation that it stop lending to wind projects.

The lending freeze was agreed with crossbench senators after the federal government adopted the committee’s interim report recommendations.

The deal included crossbench support to include forest waste in the revised renewable energy target legislation.

In a letter tabled in the Senate, Environment Minister Greg Hunt said the federal government would respond “actively and in good faith” to the Senate committee findings.

The final report says a five-year limit on renewable energy certificates, down from more than 20 years, recognised that wind turbine technology was well developed and a “mature” industry.

A ban on issuing RECS to wind farms in states that do not adopt federal guidelines on infrasound is designed to force the hand of governments that rejected a national approach at the last Council of Australian Governments meeting.

At present, noise guidelines are administered by the states, but renewable energy certificates are issued by the commonwealth.